By Tiana Baur

By Tiana Baur

What if we told you that you could be saving over $4,000 per year by going digital?

By going digital, we mean throwing out that shoebox you keep your receipts in and making it your New Year’s resolution to stick to digital when it comes to taxes. Your pocket will thank you for it and this is why.

Most agents have some sort of mile tracking app on their phones. You use it somedays, you don’t even know if it’s tracking the miles properly on others, but it’s an easy and realistic way to take advantage of write offs for your taxes. Sound familiar? We’re telling you point blank: that’s just the tip of the iceberg for business write offs and your wallet is suffering from not being proactive about all the others. It’s time to go digital.

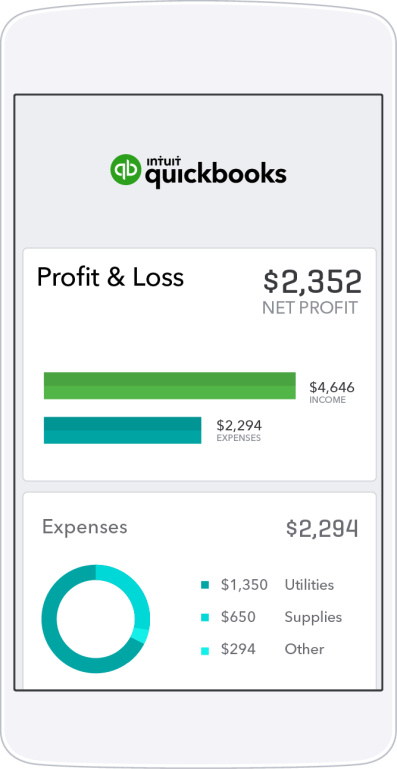

To get specific, QuickBooks Self-Employed users find on average $4,340 in tax savings per year. When you first look at that number, it might seem big or small depending on how many sides you’re doing a year, but let’s break it down and make it a bit more tangible. That’s 87 bouquets you could be sending your clients, 44 bottles of champagne you could be toasting their new home to, 20 of these Notion home monitoring systems, four new iPhone X cell phones, or this BMW Active Hybrid e-Bike – crazy, right?! Basically, what we’re saying is, that’s a LOT of money you’re missing out on.

Sure, the QuickBooks Self-Employed app tracks your miles, but it ALSO helps you track deductions for meals and fun, prompting you to take a quick pic of your receipt and uploading it so you can throw it away and never think about that old shoebox ever again. Really, how many coffees, meals and happy hours do you buy your clients and prospects each week? We’re guessing the number is pretty high up there. QBSE also helps you track write offs for marketing and ad spend, home office or space, desk fees, those big purchases like furniture and laptops, fees and licenses, travel and education, and tools and services. That’s a long list.

Up to this point you’ve been haphazardly trying to save paper receipts and remember where you drove when. Life as an independent contractor is stressful enough. Real estate agents hardly ever even get a weekend in! By going digital with QuickBooks Self-Employed, it will help bring a little sanity back to daily life and more money back into your business.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link