It’s 2022 — time sure is flying!

Our data team is already hard at work analyzing and making predictions for the year ahead, so let’s dive right in.

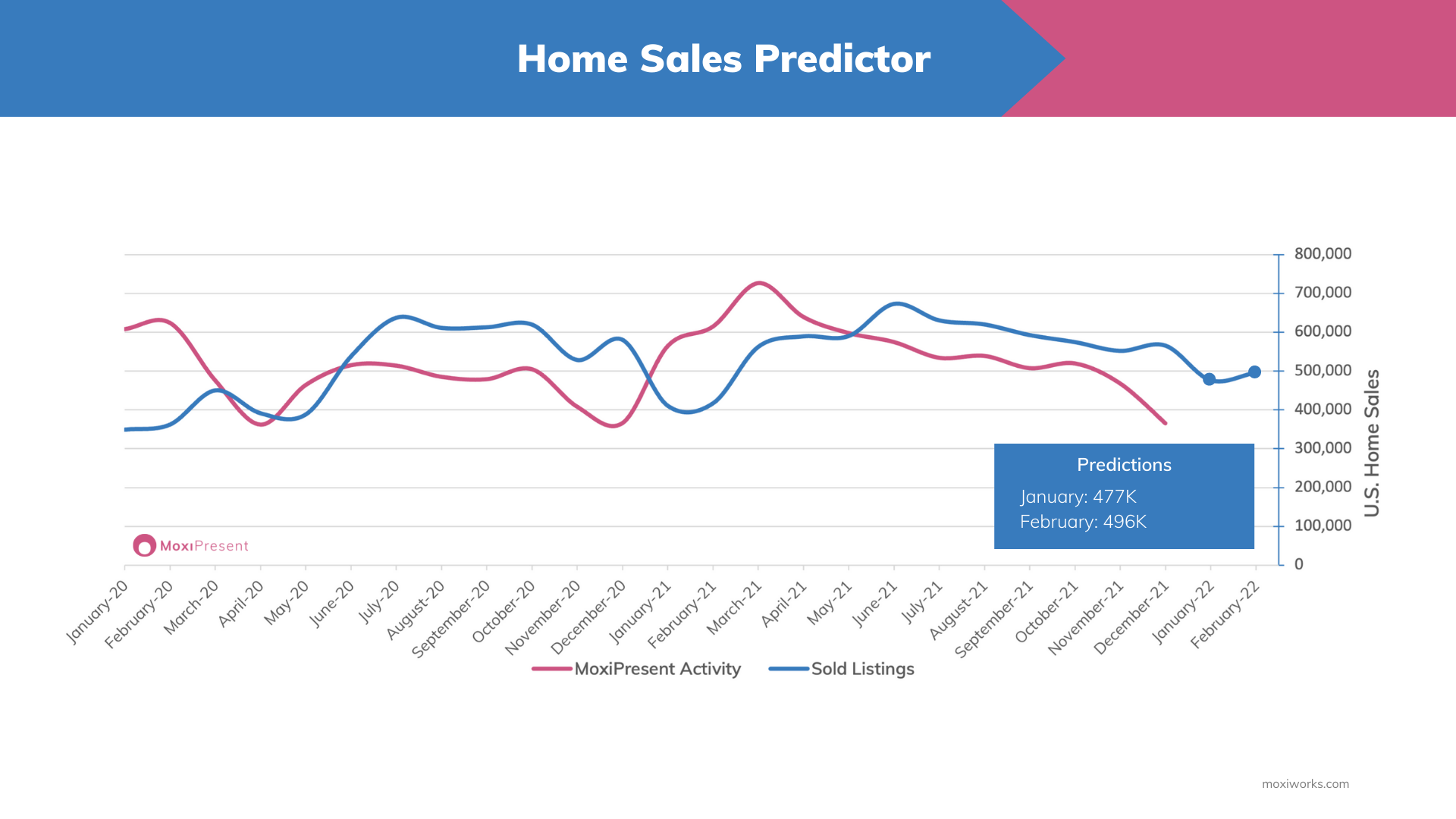

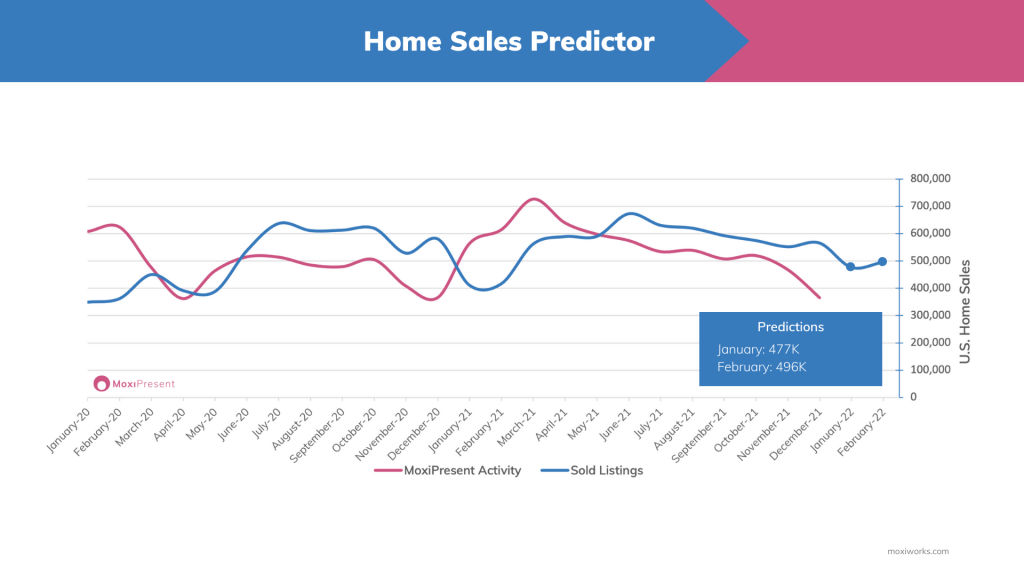

We finished December with 566K home sales which were 4% more homes sold than we expected. That was a 2% increase from November, but a 3% decrease from the year before in December 2020.

Last month in our reporting we predicted a ‘Strong year of home sales on the horizon in 2022’ and we’re already seeing that come true as we look ahead to January. In any other year, we would expect to see a 20-25% decrease from December to January.

Instead in 2022, we predict we will only see a 16% decrease with 477K homes sold, which is also a 16% increase year over year.

In February we predict we will see a 4% increase from January with 496K home sales which would be a 19% increase year over year.

Source: MoxiWorks Home Sales Predictor Jan|Feb ‘22

There are several reasons we expect to see this stronger number of home sales in January, but two of the substantial factors that will drive behavior are rising interest rates and inflation.

Inflation has now increased at its fastest pace in 40 years. And, how does inflation impact home prices? Inventory and interest rates.

Last week, the Federal Reserve Chair Jerome Powell discussed the impact of inflation on interest rates with a Senate panel:

“But some higher prices, such as rents, could prove to be stickier. Rental costs, which have accelerated since summer, rose 0.4% in December, the third consecutive monthly increase. That’s significant because housing costs make up one-third of the government’s consumer price index.

Powell told Congress that if it becomes necessary to fight high inflation more aggressively, the Federal Reserve is prepared to accelerate the interest rate hikes it plans to begin this year. The Fed’s benchmark short-term rate, now pegged near zero, is expected to be bumped up at least three times this year.” (source)

Additionally, Altos Research has reported a few other leading indicators that are also pointing to a strong start to 2022, including immediate home sales trends and increased home prices. Their recent article on HousingWire shares more about this and how that is impacting this potential flurry of buyers at the beginning of the year.

The final piece that we think is worth keeping an eye on is how institutional buying will impact the market as financial institutions are hedging in residential real estate as it’s the least likely to go down in value.

According to a recent Bloomberg survey, 1 in 5 homes that were flipped by an iBuyer in 2021 were sold to institutional investors. With inventory already at such a low, if this trend continues, when will we see it rise again?

We’ll be watching all of this closely to see how this all plays out but based on these reports last week it appears there will likely be some shake-ups in the market this year.

Buckle up!

The Home Sales Predictor is a set of prediction data that dives into the number of presentations created and the correlated number of U.S. home sales. This data is provided by MoxiWorks with insights from their MoxiPresent product.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link