![]() By Maddie Jostol

By Maddie Jostol

Taxes are a pain. Real estate agents face unique challenges as independent contractors because you’re running your own small business. This makes taxes an even bigger pain.

It’s really common for agents to miss out on deductions because the tax filing process is so time consuming and frustrating. Especially when you file on a quarterly basis, the accounting responsibilities of running your small business start to take over. Have you ever thought about how much savings you’re missing out on because you didn’t take full advantage of the deductions available to you?

A few of the many deductions to look out for:

– Mileage tracking

– Business-related technology subscription fees

– Meals and entertainment when you meet with clients

– Home office (or desk fees)

We’re going to focus on mileage tracking because that seems to be a common one for agents to miss out on. We understand why… it’s a huge annoyance to write down your mileage and then remember what that trip was for later on. We all end up with endless images of our car dashboard on our phone. That’s not exactly what you want to see as you’re scrolling through photos of your niece’s soccer game last weekend. When it comes time to file your taxes, it isn’t even worth trying to sift through pictures and records of trips you took for business. That means you’re missing out on some hefty deductions, though.

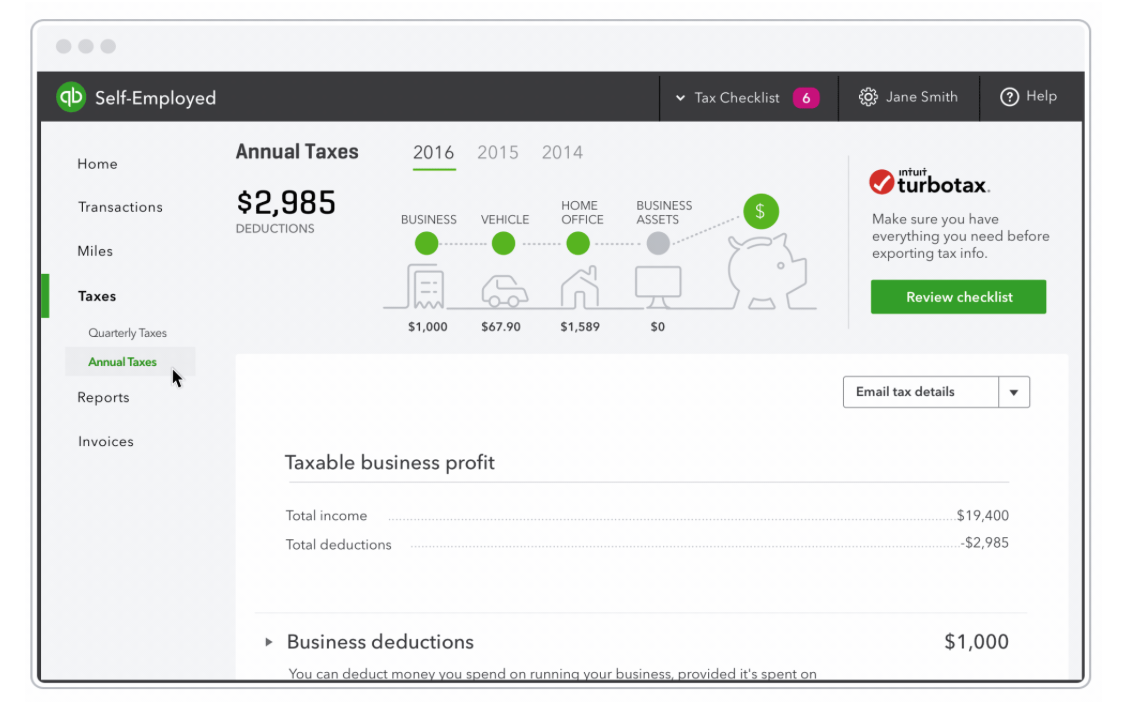

The good news? There’s a better way. We came across QuickBooks Self-Employed a few months back and realized it’s the perfect tool for busy agents. It’s an accounting tool built specifically for independent contractors, so it tracks your mileage for you so you don’t miss out on any deductions. Tracking your mileage and filing your taxes has never been easier… trust us.

When you have QuickBooks Self-Employed downloaded on your smartphone, it will track your trip every time you drive (yes, it knows when you’re in the car). Go into your app, scan your recent trips, and simply swipe left for business or right for personal. QuickBooks Self-Employed will categorize those expenses accordingly, making tax filing a piece of cake.

It also tracks and categorizes your expenses, making filing Schedule C deductions easy, you can also snap a photo and file away receipts, and see a snapshot of your business finances at any time.

Want to try out QuickBooks Self-Employed? Users are finding an average of $4,340 in tax savings per year. Since they’re a partner of ours, we’re offering you 50% off your first year. Click here for more details and to get set up!

You can also find out more about QuickBooks Self-Employed below:

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link