The dip we’ve been predicting has arrived. In July we predicted there would be a 7% decrease from June. We ended July with a 14% decrease from June with 506K home sales.

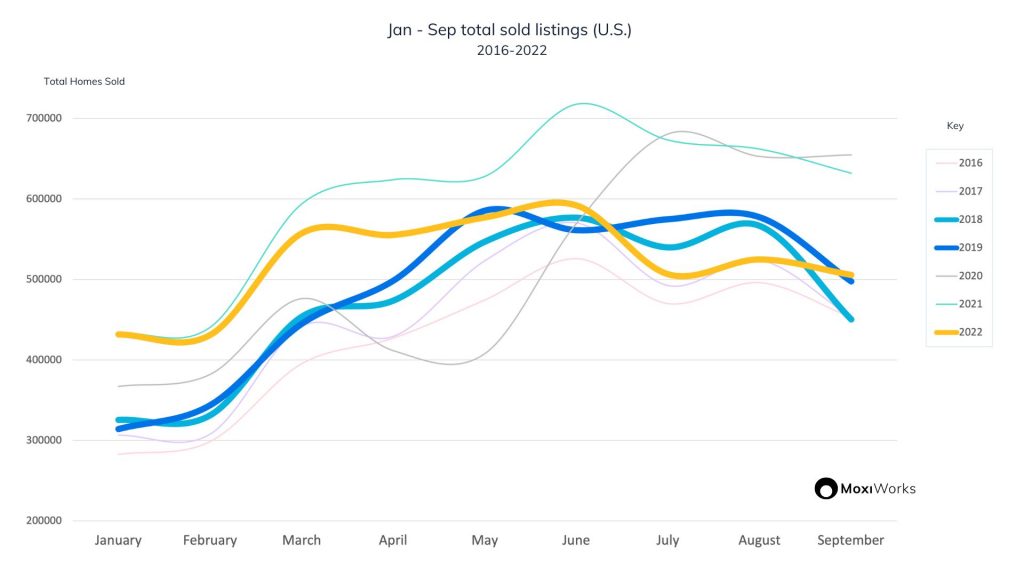

While historically the norm is for July to be lower, we haven’t had a dip of 14% between June and July since 2017. However, looking at the chart for sold listings for January through September from 2016 to 2022 we are still hovering right around/above 2019 numbers for this time of year meaning we are still holding steady.

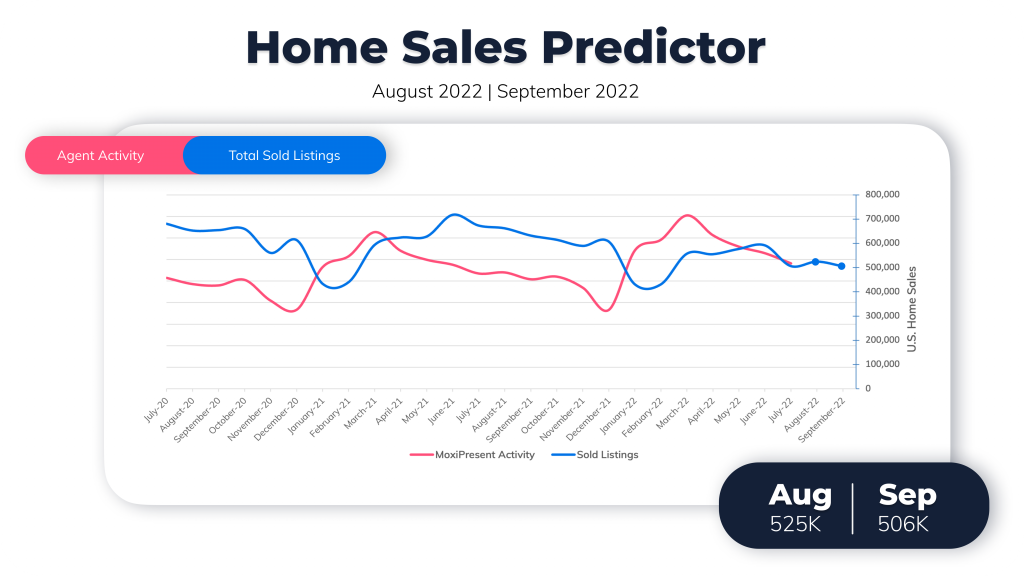

Looking ahead to the rest of August and into September we expect to see a slight increase (4%) in the total number of homes sold with 525K and then dipping back down 4% to 506K.

While reviewing the data this month, MoxiWorks’ Director of Data Services, Cass Herrin shared, “With inventory starting to slow again, in an environment where it [inventory] was already pretty meager to begin with, that puts a hard cap ceiling on what can be sold. So, it feels like for the next few months, it would be unrealistic for us to expect home sales to go beyond (500k,510k).”

Cass added that while the market may be slowing down, and it may be more expensive to buy a home, none of the data is saying buying a home is a bad idea.

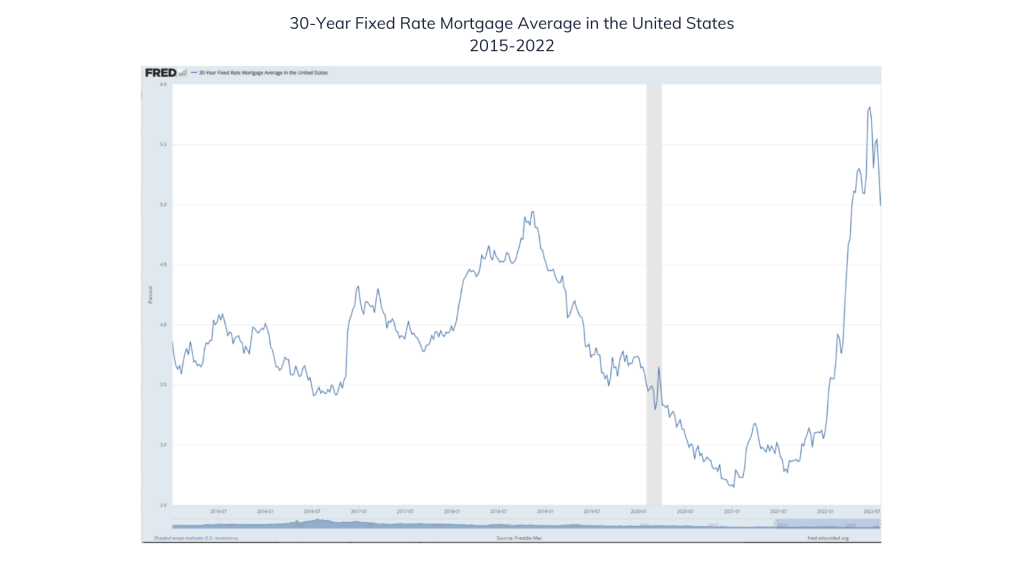

Another important thing to look at is the data around mortgage rates. York Baur, MoxiWorks CEO, shared in our company Town Hall this week some perspectives, and a reminder about recency bias.

He shared that while rates have indeed gone through the roof compared to recent years which we can see below, it’s not all doom and gloom.

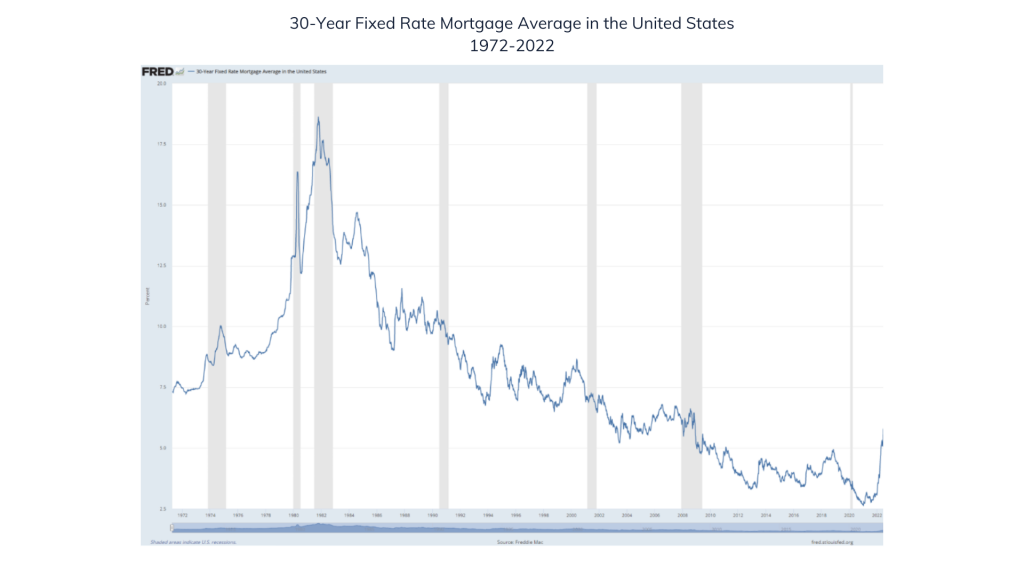

He reminded us that it’s also really important to zoom out.

Looking at rates back to the 1970s, we are still way below average historic interest rates. It’s a different picture today and we can’t let our recency bias get in the way.

York also shared another important perspective to help bring some calm among the chaos.

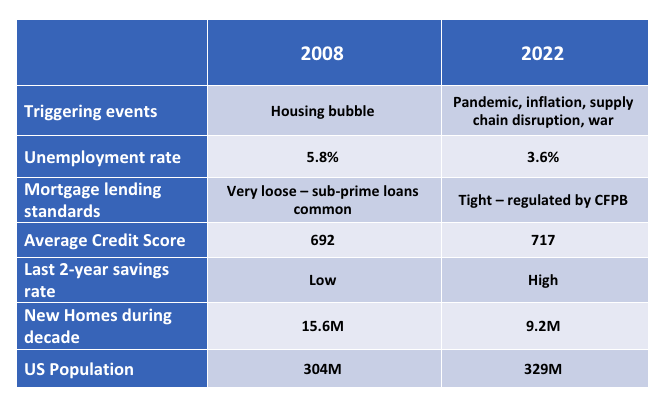

So while there are certainly some negative impacts hitting the housing market (inventory, interest rates, macroeconomic impacts) this continues to be nothing like ‘08,’09,’10.

While demand has decreased, what we’re really facing is a supply issue. So, what should you as a brokerage or agent be doing right now? It’s more important than ever to educate your current, past, and future clients on why now can still be a good time to buy or sell. It’s up to the industry professionals to help create more inventory. The best way to do this? Annual property reviews. Doing annual property reviews with your clients is an incredibly powerful lever to give the inside scoop on the value of your clients’ home and what the reality of their situation is.

Get consumers out of the news cycle and into their life’s goals and personal real estate situation. – York Baur, MoxiWorks CEO

You can check out our recent list of tips on how to present a valuable annual property review here.

With everything going on, your clients are likely not going to take action unless you show them what’s possible. You got this.

Until next month.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link