By York Baur, CEO of MoxiWorks

As we all know too well, there’s a feeling of impending doom when it comes to the future of dollars retained by the brokerage. Brokerage margin compression has been accelerating in the past few years especially, but no one seems to be discussing legit ways to battle it. And last I checked, hope is not a strategy.

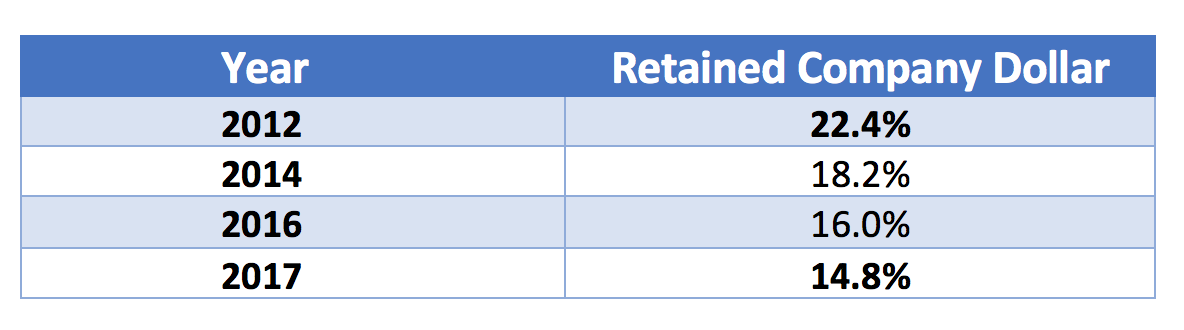

A few Moxians attended the Gathering of Eagles event that REAL Trends puts on every year, and here’s what the retained company dollar average for brokerages across the nation looks like over the past several years:

The brokerage dollar is ever-shrinking. Some may argue it isn’t a big deal since home prices have gone up, compensating on a raw dollar basis. That only works in a market with rising prices, and we all know that merry-go-round will stop at some point. We need a real plan for dealing with margin compression – it’s a core problem our industry faces. Don’t forgot that 25% of the RealTrends 500 didn’t make it through the last recession. Do you want to be part of that 25% when the next one hits?

In the face of all of this the “disrupters,” as they like to call themselves, are putting massive pressure on the need for the brokerage to have a technology offering to their agents and technology isn’t cheap. Even as a technology guy myself, I am not shy to admit it. So, how do you thread that needle? How do you buy the best technology, so you can have the best offering to agents in a world where you, the brokerage, don’t have margin to work with?

To preface this, I absolutely stand by my original viewpoint that the traditional brokerage, the impenetrable fortress that it is, has the most valuable asset that exists in the entire industry: relationships with agents, and the agents with the consumers in their sphere of influence.

With that said, here are what I believe to be viable elements of a plan for traditional brokerages to combat margin compression.

Open Platform – Not a shocker

You all knew this was coming. I won’t dive deep, but future-proofing can easily be done by getting your brokerage on a proper open platform that allows you to plug in new tools and unplug old tools just like power strip. Having an open platform means retaining your current technology investments and maintaining a foundation for all the technology changes to come in the future. And don’t be scared by claims that the disruptors will build better technology themselves internally. Over $1B has been invested in real estate tech each of the last two years, so no one company has a lock on building the best technology in every category. Having an open platform that allows you to take advantage of the best of real estate tech today and in the future trumps a “we can build it all” approach every time.

Say it with me: Recruiting, retention, AND productivity

Pick great tools that actually drive agent productivity as well as recruiting as retention. Industry wide, if you ask any broker, “what’s the most important thing in your business?” they’ll say to recruit and retain. But that’s wrong. It should be recruiting, retention, and productivity. If you focus on productivity as a major pillar of your business, it amplifies your recruiting and retention, and it’s where you actually make money. Having non-productive agents at your brokerage doesn’t make you money, it costs you money.

Many brokerages chase the shiny object, so it enhances their recruiting and retention efforts, but it doesn’t move the needle. To that point, it’s imperative to eliminate the shiny objects and steer clear of the temptation of them. They will end up costing you more than you ever thought.

Technology is NOT a single expense line item

Don’t think of technology as a single expense. Think of technology and marketing expenses together, because the two worlds have fundamentally blended. Digital marketing is inherently fused with technology and the other way around. As proof of this, an ongoing trend across all industries is the blending of the CTO and CMO roles.

Technology is not a necessary evil expense item, but as something to be used along with other marketing activities as a combined marketing and technology spend. What form of marketing these days doesn’t involve technology? Almost none.

And while I’m on my soapbox, can we please stop talking about expenses and start talking about investments? Every decision you make to spend money on something should be thought of as an investment. That means that you should expect to have a return on your investment, have a plan for making your investment work, and measuring your return over time. For example, in our case we check agent performance with our tools – agents in brokerages that are our customers do 40% more transactions when they use our stuff. That’s real productivity, and real top-line growth. Make investments and grow your business versus “managing expenses” like an accountant.

Trying to save your way to prosperity almost never works, so get on with a proactive plan to invest in a technology platform and tools to boost agent productivity. Not only will your top line grow, but you’ll be able to better stand your ground in negotiations with agents over their split, because they’ll understand that you’re helping them grow their business vs. just offering them a desk and the ability to rent your brand.

My call to action: have a plan. Focus on agent productivity. Have goals and measure yourself to them. Use technology and digital marketing to support your plan. The great news is that the traditional brokerage fortress is very hard to penetrate. But even the most impenetrable fortress can get sacked if the King doesn’t have a plan for defending it.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link