In last month’s Home Sales Predictor article we said –

“Only time will tell if this flattening trend will continue or if we will see a spike later this year. Many of our clients have shared with us they are starting to see more listings in their area so maybe we will still see a spike? What trends are you seeing? Do you think we’ve seen the peak?”

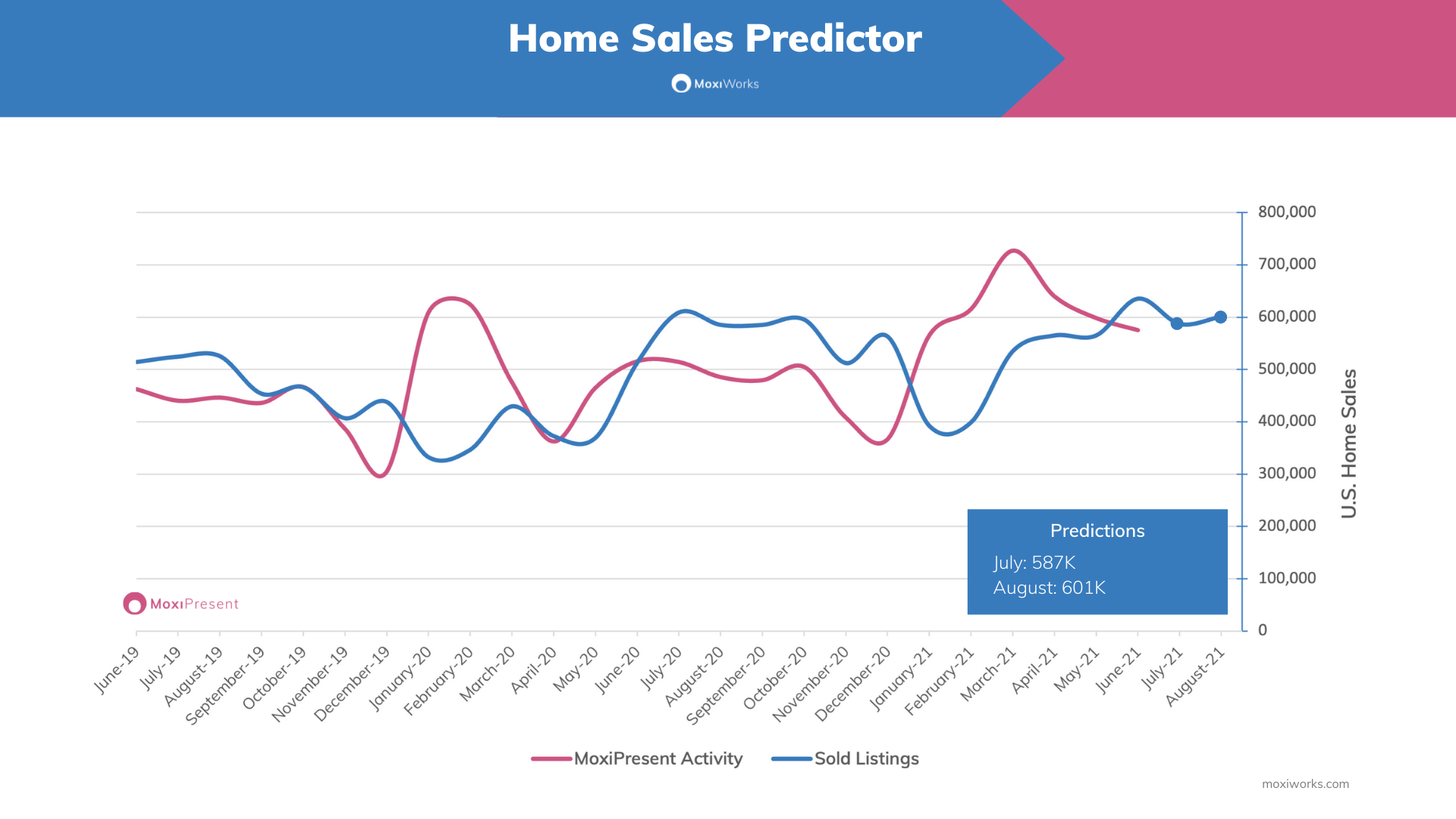

And, it appears the flattening has not happened yet. In June there were a record-breaking 636K homes sold across the US. That’s 6% higher than our prediction and 24% higher year-over-year. In fact, that is the most homes sold in a month that we have seen since we started tracking this data back in 2016.

July/August Predictions

Looking ahead it appears the market will remain hot with a brief slow down expected for July (which is a historical trend) with 587K home sales. That would be an 8% decrease from June and a 4% decrease YOY. We then expect the market to pick right back up to 601K in August. If our prediction holds true that would be a 2% increase from July and a 3% increase YOY.

When talking with our data team this month about the Home Sales Predictor one thing we all agreed on was the fact that this is a weird housing market that really feels like the tip of a lot of interesting things happening in the world right now.

Especially for us here in the Pacific Northwest. We’ve been living in a market that was mostly closed for the last 15 months, it’s been shocking to see how much has changed in the last two. And, especially in the housing market. A lot has been unpredictable and while we are confident in the data at our fingertips, time will only tell how much wackier this market may get.

Institutions vs. Homebuyers

Things are starting to look up in the economy as we return to work, travel and entertainment. There are even signs things may change for the better in terms of the housing inventory as lumber prices start to stabilize and housing starts will finally be reviving, but we still have an uphill battle to climb as more and more millennials aim to get into the homeownership game.

One of the biggest things at play that we are focusing in on is how much institutional buying is putting pressure on the already shrinking existing home inventory. We’ve been talking for months about the listings shortage vs. inventory shortage, but new data is causing us to take another look when an already pressured consumer market is seeing more pressure from the resurgence of the iBuyers (more on that below) and this further immergence of the institutional buyers that are buying homes and taking them off the market by turning them into rentals.

According to a recent Redfin report investors spent a record $77 billion on homes over the past six months compared to the $55 billion that was spent in the second and third quarters of 2020. That’s 1 of every 7 U.S. homes in the first quarter where in the previous three quarters investor bought closer to 1 in 10 homes (Source: HousingWire).

That same report shared that “Most [investors] focused on single-family homes, which made up the biggest share of acquisitions and first-quarter growth, year over year. Nearly 39,000 of the 55,000 homes investors bought in Q1 were single-family properties, up 4.8% from last year” and that among those buyers were Invitation Homes and American Homes 4 Rent, both “single-family-rental behemoths.” (source: The Real Deal)

So while concerns have been flying around about the resurgence of iBuyers it’s important to note that iBuyers are still only roughly 50% of the way back to their pre-pandemic levels with only 4,383 homes purchased in Q1 of 2021 and only account for 0.5% of homes sold across the U.S. making them nowhere near an immediate threat to our housing shortage.

What does the future hold?

The market will likely continue at this velocity, but the concerns around intuitional buyers squeezing our inventory opportunities will remain top of mind. Especially for how it can disproportionately impact the lower and middle class and especially for minorities who oftentimes lack the generational wealth to get their foot in the door, especially in a crazy market like this one.

And it’s not a great sign when, according to HousingWire “investors gobbled up the largest share of lower-priced homes in the first quarter…One of every five low-priced homes that sold in the U.S. (20.8%) was purchased by an investor, compared to 12.5% of high-priced homes and 11.3% of mid-priced homes.”

So, what can you do?

Use your power as a real estate professional to help overrepresent the underrepresented. Try and focus on building your sphere with families to help get them into homes and start building wealth and generating more opportunities for future growth. The more we can build diverse communities the better for society and the better for our future as an industry. Look for the opportunities to make positive change in your community while making sure all the homes on our street aren’t bought up by investors. Be that valuable resource for all of your contacts in your sphere and educate them on the benefits of buying and selling a home in their market to help continue to foster movement and transactions across the industry.

Sources:

- https://therealdeal.com/2021/05/21/institutional-buyers-are-flooding-single-family-market/

- https://www.housingwire.com/articles/investors-are-buying-up-single-family-homes-across-the-us/

- https://www.redfin.com/news/ibuyer-real-estate-q1-2021/

- https://www.vox.com/recode/22407667/home-sales-boom-rent-housing-single-family-rental

- https://www.wsj.com/articles/lumber-prices-are-way-downbut-dont-expect-new-houses-to-cost-less-11626260401

The Home Sales Predictor is a brand-new set of prediction data that dives into the number of presentations created and the correlated number of U.S. home sales. This data is provided by MoxiWorks with insights from their MoxiPresent product.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link