By York Baur, CEO of MoxiWorks

October 22, 2019

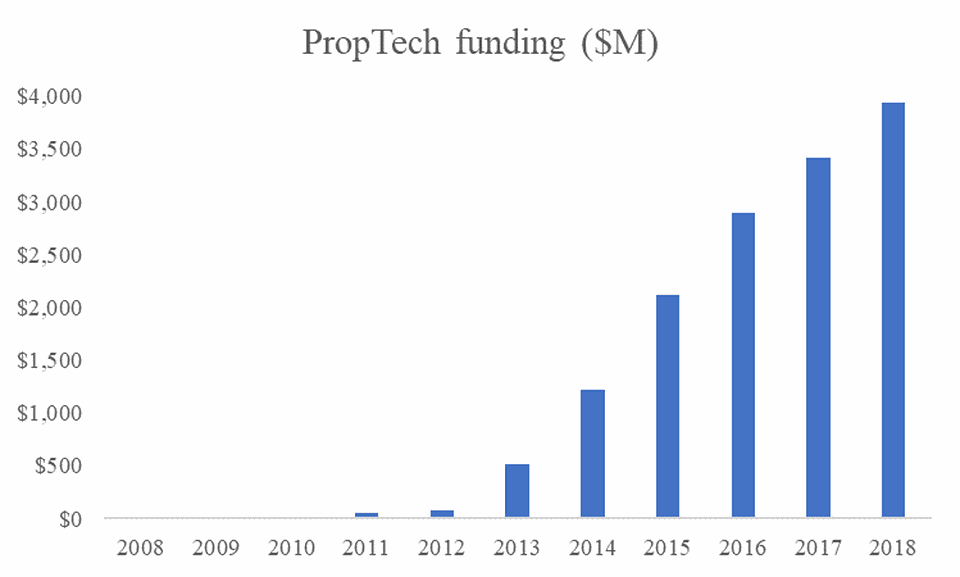

As we race towards 2020, we find ourselves in the late stages of the longest market expansion in United States history, which has led to some of the largest sums ever invested into real estate technology. To put things in perspective, back in 2008 there was only $20 million invested, whereas today that number sits comfortably around $4 billion.

While this is generally a good thing, there is a major thorn in the side of it all: the fact that the early projections for many companies of the amount of investment it would take to achieve success was wildly inaccurate.

Assumptions vs. reality.

The data challenges in residential real estate, combined with the investment required for enterprise-class systems, mean that many companies have underestimated the investment needed to achieve scale and profitability. Not only that, but many technology companies chose to sell directly to real estate agents because to them it looked like a shorter path to revenue. Unfortunately, that carries with it a massive customer churn and high customer acquisition costs, both of which limited the ability to get to meaningful revenue.

All of this makes for many, many companies in the real estate technology struggling to raise money and remain viable. The problem is, how can you tell who will survive and thrive and who will be hanging on for dear life or worse yet, gone altogether?

Brokerages beware: You must vet your technology before you sign the dotted line.

To all brokerage customers out there, beware – you need to research the financial health and financial backing of your vendors or it might end badly. The key is choosing an open platform vendor so that you have flexibility to change products out easily if and when they fail. None of us, me included, can truly know who will win and lose in the technology race so you need to protect your brokerage and agents for whatever the outcome may be.

Industry Consolidation + Risk Aversion

With the recent news of the Soft Bank’s WeWork disappointment and a very uncertain future for their other real estate investments and endeavors, we are going to start seeing risk aversion on the part of investors looking at our industry. Industry consolidation is a natural thing. As everyone races one another, only a handful come out on top. When that happens, the best-in-class products will be acquired and/or merged with other best-in-class products, and those that have struggled will likely lose out.

That’s why a well-capitalized platform provider is also a safer choice because they are in the best position to acquire the companies that are struggling and produce future stability for you and your business. It’s obvious that risk aversion and industry consolidation is near, and everyone better be ready for it when it arrives.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link